The new issue of The Review of Network Economics has a pile of articles on payment networks. The last “A Puzzle of Card Payment Pricing: Why Are Merchants Still Accepting Card Payments?” (Abstract)of which takes a run at the question of how loyal the merchants are to these networks by looking into the puzzle of why they haven’t been dropping out of the networks in droves given the rapidly rising prices.

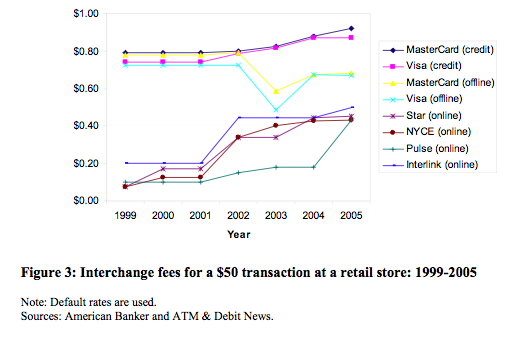

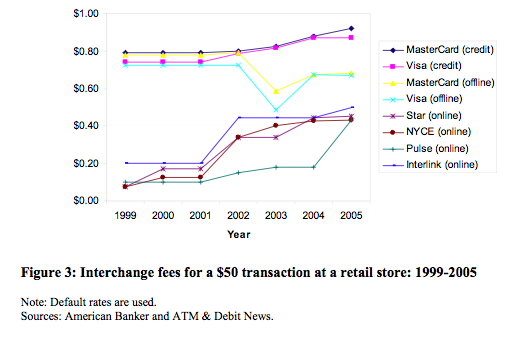

The number plotted on that graph is the price charged by the network to clear a transaction thru the network. It’s set by the network operators. This market is sufficently concentrated that those operators can signal to each other and as you can see their prices move in lock step. The only dip on the chart was do to a court case where two of the networks were accused of abusing their market power.

That chart does not show the prices merchants and consumers, the two sides of this network, actually pay since there are usually a number of intermediaries between them and that clearing house. When you add in those fees the question becomes yet more puzzling. It’s not just price that makes this an interesting question. Presumably Moore’s law and his friends have cause the cost of these networks to drop precipitously.

Clearly these merchants are extremely locked-in (or loyal if prefer that framing). These networks have accumulated a lot of market power.

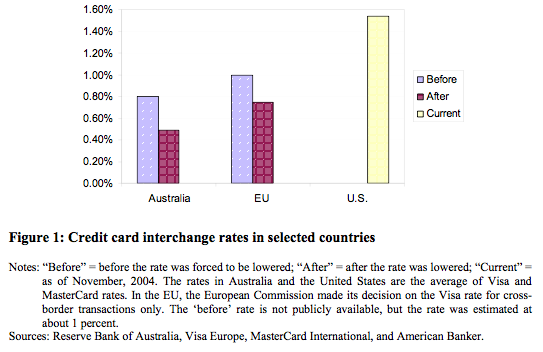

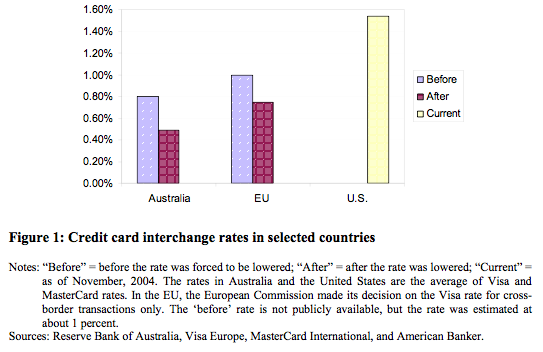

I frame this up as a question of competition between various currency systems. In particular a competition between private currency systems run for the benefit of the currency system operator v.s. state run systems run for the benefit of those who govern the state. The question the paper is trying to puzzle out an answer to is actually asking the question why do merchants not abandon the private systems in preference for the state run systems? The short answer, at least in the US, is that the state run system isn’t even a player in the game anymore – i.e. it doesn’t compete. The second chart shows that in other regulatory environments the state has used it’s power to limit the power of the private systems to tax the system.

Both the private and state run currency systems have complex governance systems. An merchant or consumer (either individually or in groups) has a lot of options for how to negotate with these systems. Consider a consortium of giant merchants. They could go to Washington and lobby for more regulation so assure that the falling costs are passed thru which would increase their sales. They could go to the courts, as they did when some of the fees dropped in the first chart, and argue that market power is being abused. They could go, and i assume they do, to their banks and demand price breaks.

There are lots of different ways the reduced costs can be passed thru to the different players. Not suprisingly when the costs drop the first player to grab them are those closest to the place where the costs are falling – i.e. hub operator.

I use a credit card that pays me 1% back on all my transactions. That makes me much much more likely to pay with a credit card rather than cash. That’s a beautiful example of how these games are played. Technology gave the payment networks lots of options. When they took this one, i.e. offering cash back credit cards, they used their market position to shift costs from consumers to merchants in a way that increased the loyality of hard holders to the private currency system. That in turn made it harder for merchants to decline the cards. It took the payement network operators a few years to discover that 1% was sufficent to buy the loyality of most of their customers; there was a fun period when I had a card that returned 5% on all my purchases.

Interesting to me is how hard it is to get the benefits to spread to the small players; i.e. the corner stores run by small businessmen. Note that if the large merchants go put the squeeze on the network operators and negotate lower costs they actually prefer an outcome that creates a disadvantage for their smaller competitors. Examples like that are why I’ve become suspicious about claims that technology empowers small actors more than large ones. I’m coming round to thinking that it’s an important driver of the depressing shifts in the distribution of wealth.