I gather that 60 million people are paid with a paper check in the United states and that almost half of those don’t have a bank account. The banking industry calls this market segment the unbanked. If you go into the neighborhoods where those folks live: instead of banks you find check cashing stores. Check cashing stores will cash your pay check and since you don’t have a checking account they will help you pay your bills. Some of them charge a lot for the service. Check cashing operations are more common in poor areas; and they are more common in states with weak consumer protection in the banking industry.

As Clay Christensen points out one way to disrupt an industry, in this case the banking and currency system, is to sneak in below their radar. Serve the people who are currently unserved. If you go after the low margin customers then the existing players won’t bother to compete with you. They don’t want those customers. This is long tail strategy. For the credit card networks I think of this as a loose change strategy.

Christensen’s displace from below strategy for disrupting an industry presumes you can find a way to serve people who couldn’t be served before. Technology provides those; particularly IT. I have a hypothisis that many of these disruptions via IT are similar. You take a previously bundled activity and burst it apart so that you then charge for smaller transactions that were previously charged for in a bundle. The IT enables that. So instead of a monthly phone bill you do pre-paid. So instead of a bank account you sell access to the banking infrastructure with a charge for every little thing.

Here’s the fee schedule for the most reasonably priced stored-value-debit card I could find.

| Check | “Balance Reimbursement” | $9.95 |

| ATM | Domestic – Withdrawal | $ 1.50 |

| ATM | International – Withdrawal | $ 3.00 |

| ATM | Domestic – Balance Inquiry | $ 0.50 |

| ATM | International – Balance Inquiry | $ 1.00 |

| ATM | Domestic – Decline | $ 0.75 |

| ATM | International – Decline | $ 1.00 |

| POS | Domestic – Transactions | $ 0.50 |

| POS | International – Transactions | $ 0.75 |

| NET | Internet Balance & Inquiry | FREE |

| Load | Via Card to Card Transfer | $ 2.00 |

| Load | Via Direct Deposit | FREE |

| Load | Via Bank of America | $2.00 |

| Load | Via Money Order | $2.50 |

| Load | Via Retail Location POS | $1.00 |

| Fee | PIN Creation | free |

| Fee | Monthly Maintenance | $ 3.95 |

| Fee | Paper Statement | $10.00 |

| Fee | PIN Change | $ 0.25 |

| Fee | Live Operator Customer Service | $ 1.50/call |

| Fee | Automated Customer Service | $ 0.50/call |

| Fee | Lost/Stolen Replacement Card | $10.00 |

| Fee | Emergency Card Replacement | $30.00 |

| Fee | Dormant Account (after inactivity of 60 days) |

$5.00 /mo. |

| Fee | Additional Maestro Card | $ 9.95 |

| Fee | Over-Limit | $30.00 |

The unbanked are the target market for these. Employers are encouraged to hand these out to new employees. That saves money for the employer because he doesn’t cut checks anymore; he just shoots the pay check straight into the card. Notice that instead of the banking term “deposit” they use the word “load.” I bet that’s because they are hoping to avoid some regulations associated with deposit accounts.

These prices are horrible compaired to a real bank account. They are pretty good compared to the check cashing store.

There is a second target market for these; i.e. Guest Workers. Or as we like to optimistically call them in this country immigrants. In that use case the card holder purchases a 2nd card with access to the same account. He then sends this back to his relations in the home country and they can pull money from the account.

There are four drivers for all this. Three mentioned so far – competition with the check cashing industry, lowering costs for employer’s of the unbanked, and better service for the unbanked. The four driver is the police authorities – all currency systems have policing issues – transaction flows that move thru the electronic currency systems are much easier to browse.

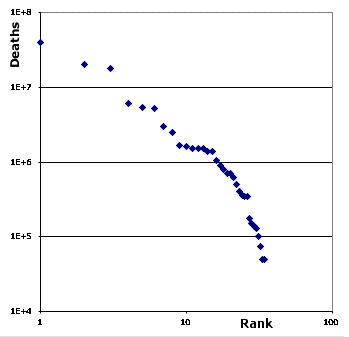

This is another addition to my collection of data about things that have a powerlaw in distribution. This one shows major conflicts of the 20th century and uses deaths/conflict as a measure of their intensity. In a sense this is a continuation of the distributions shown in an earlier posting that

This is another addition to my collection of data about things that have a powerlaw in distribution. This one shows major conflicts of the 20th century and uses deaths/conflict as a measure of their intensity. In a sense this is a continuation of the distributions shown in an earlier posting that