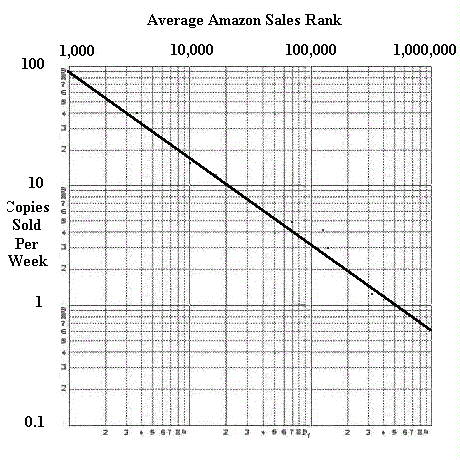

The nice thing about P2P content distribution systems is how they lower the barriers to entry for content producers. When things are working then the cost of distributing content to N consumers drops for the producer from N to 1, and the cost for the consumers rises from 1 to 2 (see here). In theory this enables content production to move much further down the long tail. It empowers the smallest players.

The design of these systems is a beautiful example of the design issues around a collaborative system. The consumers need to collaborate. If the total contributions of the consumers don’t amount to 2N then things fall apart. I’m finding it interesting to kick the tires on this problem. You can design systems to temper the freeloading by having the consumers accumulate a reputation. You can base the reputation on reports provided by other consumers. So if A provides content to B, then B can add to A’s reputation as a good actor in the system. If peer to peer exchanges happen in largely random patterns then A’s reputation will be assembled from a diffuse set of partners; making it harder to forge.

I assume it’s possible to design such a scheme. One that would allow peers in the system to know the contribution level of their partners with a reasonable degree of confidence. I haven’t looked very hard. I assume there are some papers on designing such diffuse reputation systems.

Ok, so I take it as a given that I can design a system where the participation demands a uniformity of contribution. But wait, I don’t want that! Look at the real world. Systems in the real world have multiple actors contributing to their total energy; and the distribution of their contributions is usually highly skewed. If the real world is that way, then is it a good idea to design P2P systems that effectively outlaw that distribution? What consequences would follow from that?

One thing’s clear. If you enforced uniformity you’d get class stratification. Participants of similar reputations would tend to flock together.

I’m reading a book about Common Interest Developments, i.e. the semi-walled garden highly homogenous communities created by developers. Their enthusiasts buy into a utopian fantasy. One who’s “overvalued idea” is the maintenance of property values. Other values tend to be displaced.

If we force uniformity of contribution into the architecture of P2P system, then that becomes it’s overvalued idea. Getting all fixated on the prevention of freeloading displaces other values? Why does the real world not work that way.

The delicate trick in getting the P2P reputation system may well be finding ways to encourage a diversity of participants. A means that it doesn’t lead to stratification, with that stratification and progressively tightening regulation of each group’s wall and internal norms. Very interesting tangle of problems.

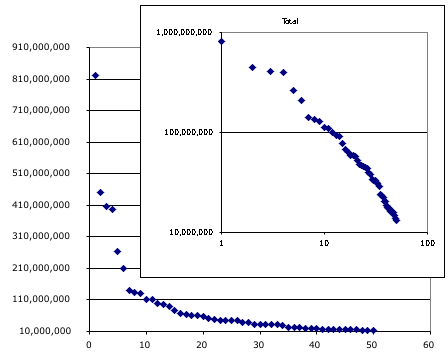

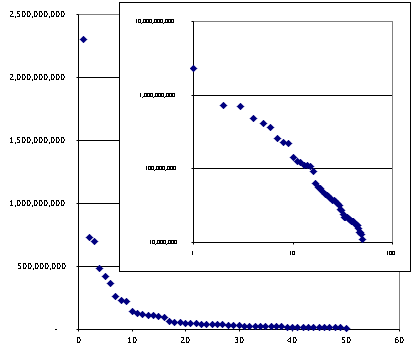

Market share

Market share

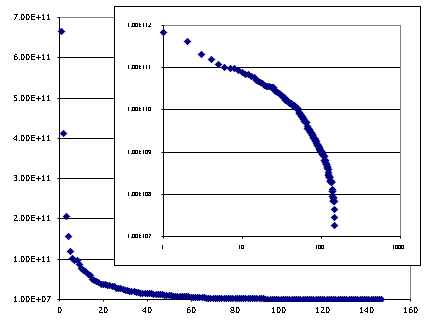

This chart has one dot for each nation’s

This chart has one dot for each nation’s