My theory is that exchange standards create networks and those networks exhibit power-law distributions. How skewed that is depends on principally on the regulatory framework around the exchange standard. Currency systems are a fine example of a exchange standard. There have always been numerous ‘currency substitutes;’ for example in the US we have coins, checks, credit cards, etc, etc. (see “war in my wallet“).

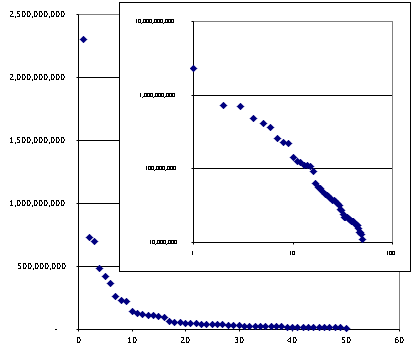

The check clearing system has a number of clearing houses. One of these is NACHA, an automated clearing house. Today’s chart shows the total transactions received by the top 50 financial institutions (pdf) connected to NACHA. This top 50 account for more than 90% of the traffic thru the exchange, and the top five account for more than 50%.

Banking is an interesting case because in the US we were very suspicious of banks so we regulated them to assure they were plentiful and small. But we seem to have gotten over that. For example interstate banks are recent development. Banking is rapidly condensing.

There is one point for each financial institution. The total transactions received on the vertical axis. The horizontal axis is the institution’s rank. One graph is linear. The smaller one is log-log there the line’s slope is -1.133.

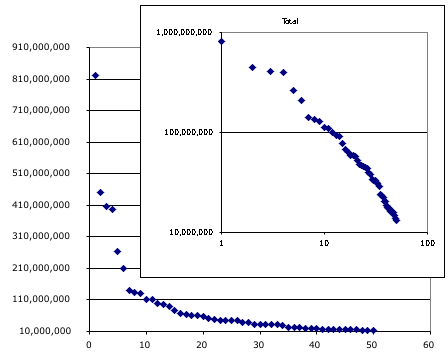

Here is the analogous chart for the institutions that originated the transactions; the slope of the line on log-log graph -1.397. Originators is more condensed.