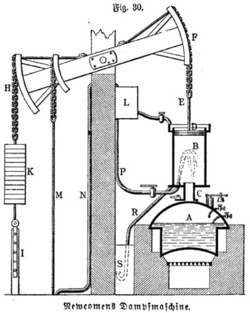

The Newcomen fire water pump consumed vast amounts of coal, but waste coal was free at the mine head.

I enjoyed this video (ht Brad) of Professor R.C. Allen outline the theory he presents in his recent book. The question at hand is what triggered the Industrial Revolution. Why Britian and associated questions. To hear him tell it the existing theory seems to be that they finally stumbled into the right institutional frameworks; reasonably good governance, property rights, etc. That theory has always struck me as suspect since it smells too much like what everybody says about the others.

His alternative theory is, roughly, that Britian was pregnant with possibility when something happened and the resulting babe thrived. Why it thrived is another story.

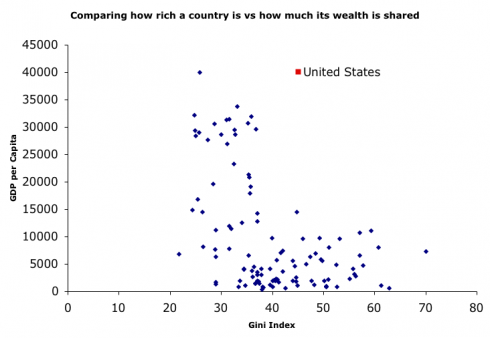

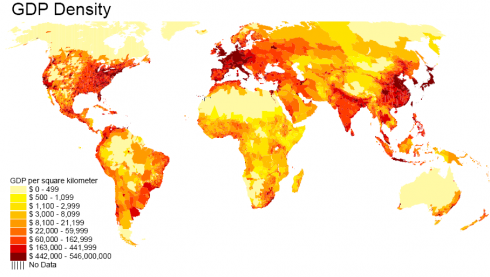

The fertile context amounted to two things. Northeastern Europe’s rising standards of living had created a consumer/commercial economy with urbanization, literacy, and consumer demand. He suggests that had happened before, say during the Roman era. Secondly a few key general technologies had emerged. Computers are the modern exemplar of a general, i.e. extremely widely applicable, technology. In this story a good example of a general technology was precision gears and rollers an outgrowth of clocks. Clocks emerged for navigational purposes and consumer demand goosed up the supply.

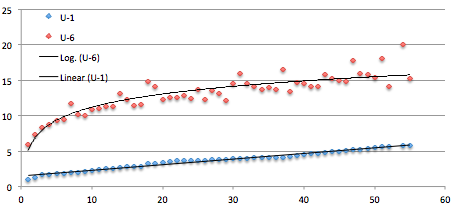

The trigger was a sky rocketing cost of labor in Britain, it happened thru out North Eastern Europe but was most severe in Britain. Rising labor costs always the calculus of production. If labor is expensive then substituting capital equipment becomes more attractive. Actually there is a more general statement. If the cost of any input rises or falls that changes the shape of how best to configure your production. So if labor gets horribly expensive, and fuel gets really cheap then you get a shift to production techniques that reduce labor, increase capital equipment by using fuel. And that’s the trigger. The Brits started building equipment which traded coal for labor costs.

He has a nice example. The French were making plate glass and cheerfully helped the Brits setup a production facility. It was obvious to the French that given the cost of labor in Britian there was no way they could become a serious competitor. What they miscalculated was how cheap coal was.

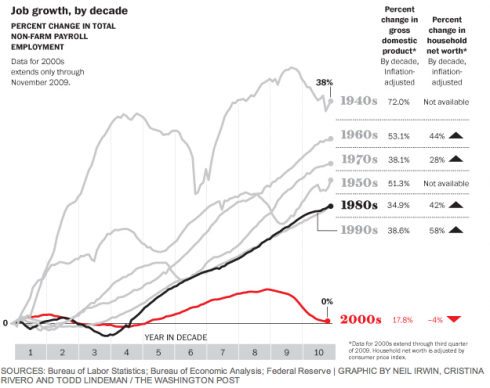

He highlights a key point about how these shifts in the factors of production play out. The new forms of production need only clear a minimal profit. Such schemes can survive only in the new niche; they can not be exported to the rest of the planet. If early in the industrial revolution you visited England, admired their cool new machines for spinning cotton, you might be tempted to head home and try the same trick. But it wouldn’t work out; absent a high cost of labor the numbers just don’t work for you. Casual observers back home will pen editorials about how your falling behind. But there is something else: learning curve. New production scheme but a babe, it has a lot to learn. That’s because it’s new. So while you get started with a minimal profit as you climb the learning curve those profits grow. Which sets up a virtuous cycle, particularly for the owners of the means of production. We used to call these guys capitalist mill owners, but now we call them VC. And as that plays out the scheme becomes exportable to countries of progressively lower and lower labor costs. The late adopters don’t get to capture the benefits of climbing the easy part of the learning curve; they don’t even get learn how to climb it.

How the Brits climbed the learning curve is another story. Having a literate urban population was good. It may have been important that the rich had fallen into a fad of amateur science and taken up hobbies involving the building of mechanisms; but this was engineering, a craft of tedious hill climbing.

It is fun, and useful, remixing this model with other models of innovation. It is surprising how often the trick of juggling the means of production into some patently inefficient, but yet slightly profitable, repeats it’s self. We are seeing a lot of that in cloud computing these days and that card was played when FPLAs where invented or in the invention of Ethernet.