Once upon a time geologists believed that, unlike California, the Pacific Northwest was pretty stable. Earthquakes? Not to worry. Other than a few Native American folktales, it’s been quiet since settlers showed up.

But, I’m reading “Cascadia’s Fault: The Earthquake and Tsunami That Could Devastate North America” (library, amazon, blog) which explains how they came to change their minds about that.

Now they think that something pretty horrific is in the cards. If you can sublimate what that means it’s a very cool detective story. I particularly like that they know exactly when the last monster quake occurred: 9pm on January 27th, 1700. They know this because of extensive written records of the Tsunami it caused hitting the coast of Japan. They know this because they found trees still standing in salt marshes, killed when the ground sank and the saltwater killed them. They pulled the well preserved roots from under the mud and counted the rings.

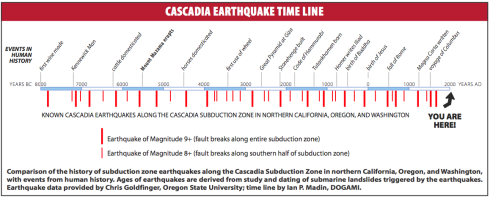

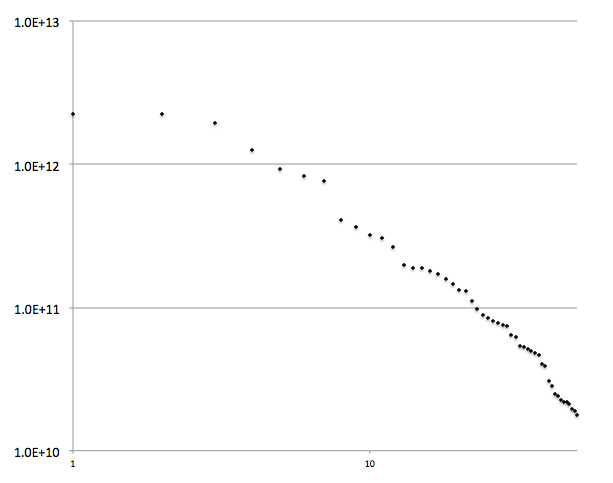

They have core samples of the off shore mudslides that the monster quakes have created. Using techniques from the oil industry they can match up the wiggles in the core samples taken from these samples they can puzzle out a history for these monster quakes that goes back a long way. They can draw a sobering timeline (click to enlarge).

They know the mountain tops are slowly squeezing together. These days they can watch the mountains of the entire region move, every day. They can sum up how much stress has accumulated. Around 60 feet of slippage will be unwound by the next quake. The big ones on that timeline are magnitude 9. No city with sky scrapers has have ever experienced that. The 2011 Japanese Tsunami was triggered by a one.

So, the state of Washington has a brochure. It suggests that most every bridge in the state will collapse.

ps. Mimi and I will be in San Francisco the last weekend of July; for the Renegade Craft fair.