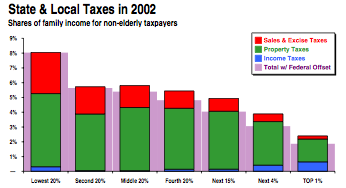

I suspect a lot of people believe that their state has a progressive tax structure. That belief is wrong. The well-off do not pay a larger percentage of their income and wealth than do the poor. There are a very few exceptions, Delaware for example – at least in 2002. Here’s what it really looks like.

Here for example is my state.

That shows how the mix of taxes effect things. In Massachusetts it’s the sales tax that really does the damage. The mix of taxes that implement this lovely situation for the parasitic well-off varys from state to state. New Hampshire manages to be extremely regressive; using a different mix.

If you want to screw the poor then here some hints:

- Avoid an income tax

- If you have to have an income tax be sure it’s flat. (that’s what we do in Massachusetts)

- Adopt a sales tax and some excise taxes

- Use property taxes

- Exclude capital gains from income

- Use tax credits to counteract progressive taxes; say on federal taxes or certain property taxes

- Be sure your sales/excise tax includes groceries, smokes, beer, and gas

- Don’t index to inflation if forced into tax brackets, exemptions, or earned income payments

- Empower local governments to raise funds using regressive means

No doubt there are much more creative schemes for assuring your tax system screws the poor. I certainly can think of quite a few without much effort. This posting is based entirely on the original edition of what is currently this report, from www.itepnet.org; you can quickly find your own state here.

This is Washington state, which makes me wonder how those Microsoft and other high tech winners feel about this.