When hanging out in the world of ideas created by Ainsle’s work Emerson’s cliche “A foolish consistency is the hobgoblin of little minds.” offers a nice perspective. Possibly Emerson’s point was that given a larger mind you can house yet more than one hobgoblin.

In related news I see that when they cleaned up the data from Google prediction market they discarded some trades, including “self-trades (which resulted from the fact that the software allowed traders to be matched with their own limit orders).” I wonder how much of that goes on in real markets. It’s clearly a sign of the temporal inconsistency which Ainsle’s work focuses on.

These trades took place between the hobgoblin that decided to place a limit order, and a later hobgoblin that decided to make a trade at that moment. It isn’t clear to me exactly why it’s best practice to remove the trades between these hobgoblins just because they were housed in the same person’s corporal body.

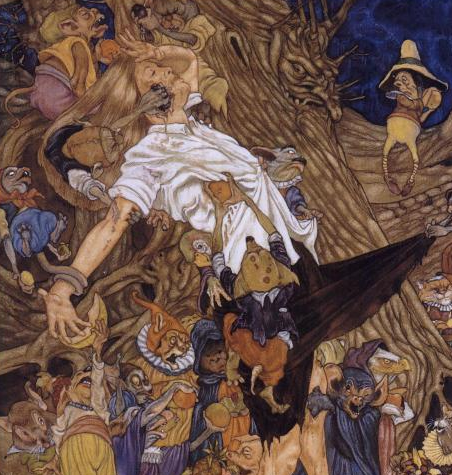

There is a wonderful classic poem, Goblin Market, here’s a bit of one of the many beautiful illustrations it’s engendered over the years. In this scene the heroine, after attempting to act as a middleman, has drawn down upon her the rage of the merchants.

.

.

Who is the painting by, please?

Thanks.

I presume it’s Arthur Rackham.

The pic is by Michael Hague, from his Book of Fairies.

George – Thanks! Yes. More here: http://artmight.com/gallery/search?doSearch=&SearchText=goblin+Market+Michael+Hague

Hi, I don’t suppose if you know what page this image is on in The Book of Fairies? I’m a literature student writing an essay about Rossetti and would love to include this but I can’t find the book.