One of the ways to get a El Curve is to take a population and iteratively reward the winners slightly in each round. This appears to be the model that gives rise to power law distributions in things like oil reserves. So I’m always interested in research that looks at the details of the iterative process in the vicinity of a system that exhibits an El Curve. Income for example.

From Brad DeLong

Very nicely done: very much worth reading:

Sam Bowles and Herb Gintis (2002), “The Inheritance of Inequality,” Journal of Economic Perspectives.

That really is a marvelous paper beautifully and carefully written. Fascinating.

I did not know that back in the 1960s there was a consensus that the data showed America to be the land of opportunity, i.e. that your parents’ caste did not tend to dictate your own. I gather from this paper that this was wrong due to an assortment of errors in the design of the studies.

Today we know that if you’re born poor your chance of rising is small; the poverty trap. if you’re born rich your chance of dying poor is small. The authors think it’s unlikely that this second syndrome will come to be called the affluence trap.

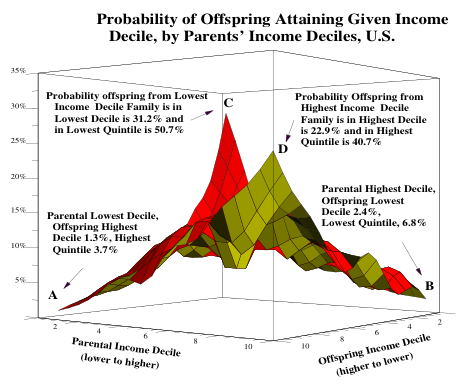

Under some definitions of fair the maximally fair society would give each child an equal chance at various levels of income. In American society if your parents had high incomes chances are your income will be high. A child born of parents in the top 10% has a 40% chance of ending up in the top 20%. If your parents were dirt poor then it’s very unlikely you will have a high income. Children born into the bottom tenth have a 3.7% chance of getting into the top 20%.

The paper includes this great peice of eye candy. This shows the chance a child will fall into a given 10% of the income range given his parents’ position in that range. The two peaks are the poverty/affluence traps.

The fun thing about the paper is the very careful attempt they make to tease out of the data some information about the causality of the intergenerational income status trap. The extent of the trap is really amazing. If you average income over 15 years then the correlation is .65. That means there is a 65% chance that the next generation’s income will be within 1 standard deviation of the previous ones.

Of course what one wants to know is what’s the causal chain from one generation to another. For example maybe the key driver of wealth is a sense of humor (though i doubt it) and parents tend to pass that on to their children a bit by nature and a bit by nurture. The nice thing about the paper is that they make a really substantial effort to draw out of the data as much causality as possible. This is almost impossible since there are plenty of causal chains for which the data is very very thin.

Of course all this stuff is very tangled. Wealthy parents tend to buy more schooling, for example. The trick is to condition the results so you’re getting a reasonably pure contribution from each stage. I.e. so if you doubled the schooling without changing the parent’s wealth your model would predict accurately what the change in outcome would be. That’s really hard. For example it’s common to use data about twins or brothers to try and tease out the differences between nature and nurture. But even that’s very subtle. For example we know the height is very tightly tied to genetics but we also know it varies tremendously depending on how well people are eating. We know that brothers tend to have very similar incomes, unless you partition the data by race at which point you discover that black brothers are extremely highly correlated and non-blacks much less so. They do a beautiful job of stepping thru this mine field.

Here are the numbers they manage to pull out of the data:

- 4% IQ

- 7% Schooling

- 12% Wealth

- 2% Personality

- 7% Race

The key result of the paper is that 32% of the trap remains unexplained. It’s something else. Humor say.

I still have an affection for my five ways to get rich model (pick the rich parents, spouse, pocket, card, or trade).

I’m willing to bet that a large percentage of the remaining 32% is social capital.

From http://www.bowlingalone.com/socialcapital.php3 :

The central premise of social capital is that social networks have value. Social capital refers to the collective value of all “social networks” [who people know] and the inclinations that arise from these networks to do things for each other [“norms of reciprocity”].

Hm. I spell doctorate title: “Intergenerational Social Capital Transfer” 🙂

I particularly like that social capital originally meant the set of capital equipment you could borrow from your acquaintances; doesn’t seem to mean that anymore since information (a public/club good) is typically what people now think of as what travels thru the social network.