Another chance to be gobsmacked by industrialized agriculture: A ten fold improvement in productivity discovered for maple syrup production. You just need to remove all the romantic aspects. And just think! When the remove all the existing sugar bushes the cost of maple furniture should drop.

Another chance to be gobsmacked by industrialized agriculture: A ten fold improvement in productivity discovered for maple syrup production. You just need to remove all the romantic aspects. And just think! When the remove all the existing sugar bushes the cost of maple furniture should drop.

Category Archives: business modeling

Selling out your Friends

Robert Shiller: “It’s not the financial crisis per se, but the most important problem we are facing now, today, I think, is rising inequality in the United States and elsewhere in the world.” And he won a Nobel Prize.

I have a theory about this problem. Think of the set of all the world’s supply chains as a network. I think we need to grow this graph so it’s a lot more bushy at the low-end. Shrubbery! I guess this theory shares a lot with Bill McKibbon’s ideas in Deep Economy; or the Prahalad’s ideas in Fortune at the Bottom of the Pyramid.

‘I don’t keer w’at you do wid me, Brer Fox,’ sezee, ‘so you don’t fling me in dat brier-patch. Roas’ me, Brer Fox,’ sezee, ‘but don’t fling me in dat brier-patch,’ …

I continue to harbor great optimism about the Internet, It can help us with this. The Internet has an amazing power to enable communities of common interest to form. These communities are great of shubbery. Precursors of commerce? Maybe.

But, it’s worth chewing on the ideas in “how to lose friends and family via mult-level marketing” a posting that Andrew highlights. Andrew introduces the idea that MLM schemes provide a way for people to liquidate (e.g. convert to cash) their social networks. Liquidate is what you get when your done the monetizing a social network. Lots of people are into that. Monetize – what a word! What can’t we monetize, my cat?

So while I love the Internet’s power as a host of community forming I must say I’m taken aback by how rapidly capitalism has evolved businesses models that feed on these tender shrubs.

Ironically my social network got infected by one of these parasites just today. A friend signed up for Venmo, a p2p payment company, and they posted this exciting fact to Facebook on his behalf. I admit to an unhealthy curiosity about these emerging currency systems. For example, I think Bluebird is very interesting. So I went and signed up for Venmo and installed the app. A few moments later I was distressed to discover it was scanning the entire address book on my phone, maybe a few thousand entries. If you want to use thier payment network you have to hand over your contacts. No way to void it. So I uninstalled, etc. Who knows if that helped?

I totally get that building out “the network” is an existential issue for companies like Venmo. Desperate need is an excuse in a starving man, is it an excuse for a start up? Not that you need to worry about Venmo. Venmo got bought, and the buyer then got bought by Paypal. So they captured and sold a network. That this is what most internet startups need to do worries me.

Returning to shrubbery as a tool to work inequality problem. No doubt there are many much more ethical ways to convert the small communities into engines of economic activity. It would be great to have a list. No doubt looking at MLM business models would inform that search.

Gauntlets of Adverse Selection v.s. Healthcare Exchanges

Adverse Selection is the name for a common syndrome in markets where “market participation is a negative signal.”Adverse Selection is the name for a common syndrome in markets where “market participation is a negative signal.” For example you always gotta worry if they guy trying to buy life insurance is old and sick, or the guy trying to get a mortgage can’t pay for it.

Adverse Selection is the name for a common syndrome in markets where “market participation is a negative signal.”Adverse Selection is the name for a common syndrome in markets where “market participation is a negative signal.” For example you always gotta worry if they guy trying to buy life insurance is old and sick, or the guy trying to get a mortgage can’t pay for it.

The new healthcare exchanges have this problem. The “worse,” i.e. most needy, customers are the one’s mostly likely to struggle thru the frustrating the sign-up gauntlet.

This failing of the software architecture and implementation. It is required by the system’s political architecture. The tangle of means testing, shopping metaphor, and the federation of insurance companies, states, and federal agencies forces it. Let’s just pray engineers and their managers can make the gauntlet less daunting.

Google’s Enclosure of Android

I while back Ars Technica wrote an article about Google’s Play Services on the Android. They treated Play Services as the solution to a problem, i.e. getting updates to the phone. Carriers, hardware vendors, and users all make this hard. Platform vendors often run into the problem that their installed base becomes immovable. Play Services routes around these guys, it has its own update path. Ars Technica even went so far as to suggest Google might not need to make Android OS releases as often.

At the time I disappointed. They didn’t seem to recognize how this was really about moving Android from Open Source to proprietary. Well, this new article certainly fixed that! Now they get it.

Google is doing an amazing job of locking down the actors the complement this business. They are gaining control of the users, the hardware vendors, the carriers, and the app developers. If you do business architecture around Open Source you need to understand this stuff! The article is a handbook for how to enclose an open source project.

Did they plan this? Or did it just emerged organically from the nature of the business? I’d love to know the people who can do the former, but the latter is much easier on one’s conscience.

This and That

A new Whole Foods Market opened in my neighborhood. It has a twitter account. As do all the other stores around the area. They all twitted their congratulations. I wonder if their little community of stores has problems with bullying.

I do enjoy following testually.org, a blog about texting. In this episode we learn about the effort to prevent marathon runners from taking selfies during the race after somebody dropped their phone as the Hong Kong marathon started.

But wait, what about the social network of brands? Why don’t we see more brands flirting on twitter and facebook? Here’s a bus in DC with a blog talking about a craft fair. Of course every transportation network should have social network too.

Apparently in-spite of it being legal to ship wine into Massachusetts now it remains rare. Only Fedex has done the paper work; and they will only ship from a seller who has registered with them. And, the shipper maybe reluctant to ship to you into Massachusetts since he can’t discern if your getting close to your annual limit. Which goes to explain why there are only a few places that will ship.

People! Don’t forget the metadata! We need an catchy name for the practice of enticing people to click thru with a content free teaser. I.e. “This make me think!”, “Best video ever”, “Must watch”, “4 key risks you can avoid”, … etc. Then we can tease people for using them, and pledge to never click ’em.

Let this be a warning of the risks of letting you children watch too much Gumby or Gromit. Clearly claymation is for wimps. Be sure to scroll thru the photos so you can see the flip book the made from the individual pieces of embroidery.

Let this be a warning of the risks of letting you children watch too much Gumby or Gromit. Clearly claymation is for wimps. Be sure to scroll thru the photos so you can see the flip book the made from the individual pieces of embroidery.

Mentor market

When I arrived at college in the early 70s the basement of the student center had a ride share board I could use to hook up with somebody for the trip back home. It died out pretty quickly, apparently the cost of travel crossed some threshold (or the coordination costs rose) and the students started traveling on their own. These days there are services to help you find a second passenger so you can use HOV lane, and there are a few rider matching service popping up that are in fact more analogous to taxi companies.

When I arrived at college in the early 70s the basement of the student center had a ride share board I could use to hook up with somebody for the trip back home. It died out pretty quickly, apparently the cost of travel crossed some threshold (or the coordination costs rose) and the students started traveling on their own. These days there are services to help you find a second passenger so you can use HOV lane, and there are a few rider matching service popping up that are in fact more analogous to taxi companies.

Matching services (Intervac, OK Cupid, etc. etc.) a subset of middlemen, account for a large swath of the various species of internet business models. There are even firms that have portfolios of match making sites.

There are have historical precursors for all these match making buisness; like my school’s ride share board or the gay hook up that used to circle the block across from an apartment I rented.

And then, I was triggered to recall ads in the subway in NYC for SCORE. And I see that SCORE, service that matches small businesses with retired business mentors, is still around. I was reminded by a PR piece in today’s paper about an internet business based on a similar idea. PivotPlanet brokers matches between small business operators and folks that are thinking about getting to that line of work. It’s pricy; for example say you wanted to shadow a micro-brewery operator for a few days; that might cost you $120/hr – but they are all booked up. So maybe an ice cream shop instead. They have a long list.

There is a bit of literature about why small business men in a given industry don’t actually compete with each other, but instead generously and enthusiastically share information with each other. So I don’t find this surprising. And then there is that pattern where the house flipper gets out of the business and instead sells a training program buy renting a boat hiring some pretty girls and making a late night infomercial.

I find it fascinating that the founder originally started Pivot Planet as a kind of travel agency. He was selling “vacations” where you visited the mentor. That’s kind of similar to the agencies that broker trips to interesting places where you do some service work as part of the trip. But then there is a lot of specialty travel brokers. The boundaries between education, training, and recreation keep getting fuzzier.

Ray Dolby’s business model

I read Ray Dolby’s obituary in the New York Times because the Dolby noise reduction system is a textbook example of a two sided network business model. Invented in the early 60’s the system enabled you to get better audio quality out of recorded sound. It transformed the audio signal to route around flaws in the tape, tape heads, and transport mechanisms. The problem it solved grew quite severe when cassette tapes became popular. To get the benefit a lot of parties along the supply chain needed to play along. Two in particular. The companies that manufactured cassette players and the companies the manufactured the cassettes containing the entertainment.

I read Ray Dolby’s obituary in the New York Times because the Dolby noise reduction system is a textbook example of a two sided network business model. Invented in the early 60’s the system enabled you to get better audio quality out of recorded sound. It transformed the audio signal to route around flaws in the tape, tape heads, and transport mechanisms. The problem it solved grew quite severe when cassette tapes became popular. To get the benefit a lot of parties along the supply chain needed to play along. Two in particular. The companies that manufactured cassette players and the companies the manufactured the cassettes containing the entertainment.

The obituary get’s it wrong. Dolby’s achievement wasn’t the signal processing algorithms; his achievement was getting all the players to sign onto his system. Two-sided networks (standards) are all about the difficulty of attracting, coordinating, and locking-in two diffuse groups. Dolby managed to own a standard. And so he got to charge a toll for his small part in intermediating between sound producers and consumers. . He them managed to steward that role so that even today his company (DLB) stands at the center of the standardization of sound. Next time your watching a DVD notice how right there in the credits the Dolby name will appear. Think about how much time and space that credit takes v.s. other contributors. And today, it’s all digital!

The obituary get’s it wrong. Dolby’s achievement wasn’t the signal processing algorithms; his achievement was getting all the players to sign onto his system. Two-sided networks (standards) are all about the difficulty of attracting, coordinating, and locking-in two diffuse groups. Dolby managed to own a standard. And so he got to charge a toll for his small part in intermediating between sound producers and consumers. . He them managed to steward that role so that even today his company (DLB) stands at the center of the standardization of sound. Next time your watching a DVD notice how right there in the credits the Dolby name will appear. Think about how much time and space that credit takes v.s. other contributors. And today, it’s all digital!

I wonder if any of the New York Time’s obits talk about the deceased’s business model.

prices are forward looking

One of the old languages, Aymara, of South America has a unique feature. Events in the past are said to be in front of the speaker, i.e. where he can see them; while those in the future are behind him.

If you think about it a little it makes sense. You can’t see the future. But, you can call up memories of the past. So in sense that is all you can see.

But, yeah, doesn’t that treat memory as more valid your imaginary futures, your plans. It hardly seems fair to treat one tenuous mental model as more real than the other. It makes me wonder is Aymara the perfect language of nostalgia?

I was reminded of all that by this essay which digs into the common presumption that you deserve your income.

“Free market prices are essentially forward-looking. Current prices send signals to producers as to where the demand is now, not where the demand was when individual producers decided on their production plans.”

I like to say that there are two simple naive ways to think about the price of something: that it cost to make v.s. what it value the buyer will extract from it. If $cost < $value then we can negotiate. There are uncountable reasons why this model is too simple, but it’s still useful. In part because it’s nice and symmetric, the seller doesn’t want the buyer to know $cost and vis-a-versa. They keep their secret, but it looms large in their mind. During the negotiation the buyer strives to dampen the seller’s nostalgia and his own valuation; while the seller does the opposite.

If I have labored a life time to acquire some skill then I know that my $cost is high, but the market doesn’t care. The market is just as likely to have a high $value for things that skills that were trivial to acquire. This is a line of reasoning that I am familiar with for most products, but I’ll admit I’d never seen it so boldly stated for transactions involving skills.

The Modern Gentlemen’s club

I inherited from my father an affection for cartoons. I still have his books of Punch, and a complete set of New Yorker cartoons. One of the standard tropes in these collections is set in a gentlemen’s club. Two large cigar smoking elderly gentlemen recline in leather arm chairs. One says something to the other. Such as: “I think I’ve acquired some wisdom over the years, but there doesn’t seem to be much demand for it.”

Men’s clubs seem to be rare in America. We used to have lots of them. The suburbs and television sucked the life out of the, or so I’m told. And the term “gentlemen’s club” now has become a euphemism.

Men’s clubs seem to be rare in America. We used to have lots of them. The suburbs and television sucked the life out of the, or so I’m told. And the term “gentlemen’s club” now has become a euphemism.

But, for the rich, the men’s club solved a problem. It got them out of the house. Which is a serious problem if your a type A over achiever, since chances are you married a type A over achiever. Imagine the trouble. You sell your startup and decide to spend more time with the family only to discover there isn’t really room at home for two over achievers 24×7.

In the good old day’s you’d join a good club. And added bonus: you could sit around and whinging about who the youth of today are going to hell in a hand basket.

But of course capitalism is very good at filling demand, particularly when those who have the need happen to have disposable income. And thus we have the venture capital firm. It’s actually better than the classic gentlemen’s club. You can still have the comfortable digs, the high end dinning room, the subscription to all the daily rags. But it’s better! Instead of complaining about the young you get to invite them in and give them advise!

That’s an old joke of mine, though it’s not entirely clear if it’s a joke or a deep insight into some aspect of the venture capital firm’s value proposition for it’s partners. Memory is an untrustworthy beast, but I’m pretty sure I came up with this joke after hearing of a VC firm in the valley that had a wall down the middle; one one side it was pure luxury and on the other it was standard spartan office space. As I remember the story the partners would always meet the entrepreneurs on the spartan side of the wall.

And so, it was with great delight that I read an article in today’s paper. A friend of mine, having recently exited from his last of a series of successful entrepreneurial activities appears to have taken my insight to heart. He is setting up a startup incubator here in Boston. And make no mistake: that’s is honorable work. But this was the sentence that delighted me:

English says he’s planning an “outrageous” workspace that will transform into a club at 6 PM, with regular events that “celebrate creative people” like dancers, sculptors, and clothing designers.

That is definitely an improvement on my original insight.

Metering, discriminatory pricing, subscriptions … Adobe.

Pricing is a mess. On the one hand you can argue that things should cost exactly what they cost to produce (including, of course, a pleasant lifestyle for their producers). On the other hand you can argue that they should cost exactly whatever value their users extract from the product. Surplus is the term of art. If you charge less than the value extracted the consumer is left to capture the surplus value.

More than a decade ago I had a bit of fun at the expense of my employeer arguing that we should switch all our pricing to subscription, just as Adobe has just recently decided to. My suggestion was greeted with an abundance eye rolling and head shaking.

Leaving surplus value on the table can be very risky for the producer. It’s not just about how pleasant a lifestyle he get’s (aka greed). Businesses are multi-round games; what you can invest in the next round of the game depends on how much of the surplus value you capture v.s. your competitors. But also businesses with large market share and large volumes gain scale advantages that drive down costs, establish standards, and generally create positive feedback loops. (That leads to the perverse tendency for the largest vendor to be the best and the cheapest.) Which brings us to discriminatory pricing, aka value pricing.

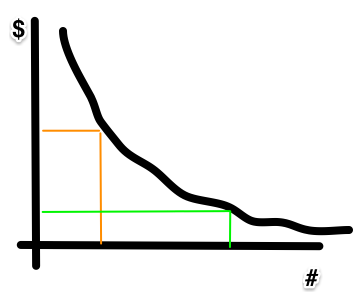

The demand side network effects depend on the scale of your installed base. Discounting lets you reach users that you wouldn’t otherwise. If you can segment your market then you can enlarge it. There is a standard text book illustration for this.

That chart shows the number of buyers your product will have if you charge various prices, or looking at it another way it’s showing you how much value users think they will get from your product. If you’d like a lot of users you should charge the green price. Your total revenue is, of course, the volume of the rectangle. Why not both? Why stop there? As a vendor, what you’d love charge everybody exactly what they are willing to pay. You could have both the maximum number of users and all the volume (revenue) under that curve.

Subscription pricing gives you a tool, because it lets’ you meter usage, that can stand in as a proxy for the value the users are getting from the product.

I was surprised by Adobe’s subscription pricing, not because it’s expensive and draconian. No, I was surprised because it appears to have no metering. My insta-theory for why? Well I think what we are seeing at this stage is the classic: e.g. “list price.” That they will start offering various discounted variations on the service. It would be odd if they don’t. Because, otherwise, they are leaving two things on the table. They are shunning a huge pool of users, missing out on all the demand side network effects they create, and encouraging competitors to fill into that abandoned market segment. And, they are leaving money on the table.

I’ve no idea what they will meter, but I’d be surprised if they don’t.