I wish the right would stop complaining about how unfair the tax system is to the rich. That’s a lie. The tax system is regressive. The well off pay a smaller percentage of their income than do the poor and the middle class. It’s a lie and they shouldn’t be allowed to get away with this lie.

The recently released video of Romney’s at fund event at the home of the infamous sex party hosting hedge fund manager holds few surprises about what the far right actually believes. E.g. that Democrats are indistinguishable from welfare queens. That the nation is drifting toward a democratic take over. That the underclasses spend their day in leisure, sucking the life force from the helpless upper classes.

That polarizing view has been a core value of the far right forever. And recently it has become a core believe of the Republican party. They went off the deep end a long time ago. Low (even medium) information voters are still unlikely to realize this. Still.

Some of press have called this a “gaff.” You know … falling off message is one thing and revealing your honest beliefs is another. This was the latter.

The tax system is not progressive. It is not Robinhood. It does not tax the rich more than the poor. In fact it taxes them less.

I have found the press coverage frustrating. The counter point to his remarks has been weak. The meme he was repeating was that 47% don’t pay takes and just take from those that “make.” He obviously believes this. The counter point has been in order: Try to go all technical an point out that he is confusing the listener by a narrow definition of taxes and then highlight other taxes. Then there is the appeal to emotion response – were we mention the elderly, children, students, and military. Finally there is more sophisticated technical point that this situation was engineered by Republicans, as part of the reegineering they did to the poverty programs over the last decades. For example they introduced Earned Income Credits so that firms could offer low paying jobs and with the help of the credits people could barely survive doing those jobs – assuming they can figure out how to do the paper work.

What frustrates me is that these reports don’t bother to mention the core lie. It is a lie that the tax system is punishing the rich and transfering money to the poor. It is not. The tax system is not Robinhood. If you think so then you are misinformed. The rich pay a smaller portion of their income and wealth into the system than do the poor. If we embrace the victum/parasite framing Romney is using – well then – it’s actually the other way around. They are the parasites and the lower and middle class are the victums of their free riding.

I rarely do this, but here is a very old posting that explains the details.

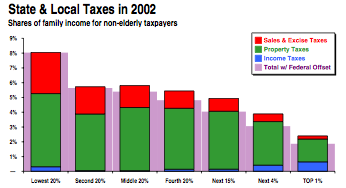

I suspect a lot of people believe that their state has a progressive tax structure. That belief is wrong. The well-off do not pay a larger percentage of their income and wealth than do the poor. There are a very few exceptions, Delaware for example – at least in 2002. Here’s what it really looks like.

Here for example is my state.

That shows how the mix of taxes effect things. In Massachusetts it’s the sales tax that really does the damage. The mix of taxes that implement this lovely situation for the parasitic well-off varys from state to state. New Hampshire manages to be extremely regressive; using a different mix.

If you want to screw the poor then here some hints:

- Avoid an income tax

- If you have to have an income tax be sure it’s flat. (that’s what we do in Massachusetts)

- Adopt a sales tax and some excise taxes

- Use property taxes

- Exclude capital gains from income

- Use tax credits to counteract progressive taxes; say on federal taxes or certain property taxes

- Be sure your sales/excise tax includes groceries, smokes, beer, and gas

- Don’t index to inflation if forced into tax brackets, exemptions, or earned income payments

- Empower local governments to raise funds using regressive means

No doubt there are much more creative schemes for assuring your tax system screws the poor. I certainly can think of quite a few without much effort. This posting is based entirely on the original edition of what is currently this report, from www.itepnet.org; you can quickly find your own state here.

This is Washington state, which makes me wonder how those Microsoft and other high tech winners feel about this.

Aw, come on! Of course the tax system is regressive. It’s been that way since the 1980s. Everyone who can do arithmetic (oops … just excluded a majority of folks) knows that. OK, maybe it’s not ‘do’ arithmetic, but *think about* arithmetic.

Me