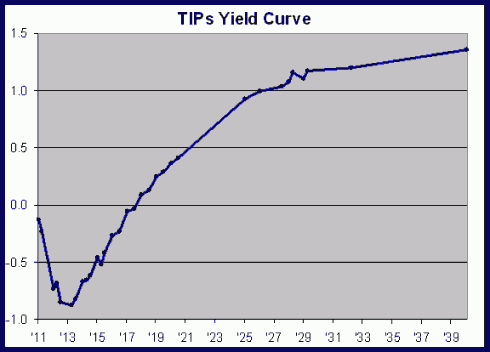

Update: As pointed out in the comments I was confused by what that chart was showing… ignore the following.

When you put your money in the bank that bank promises to keep your money safe and then give it back later. When I was boy they also gave you a bit of interest, but recently they scoff if ask about that. In fact these days they usually manage to charge you some fees so that when you get your money back it’s actually less than you put in. In this situation it starts to seem reasonable to just keep your money in tidy bundles at home.

When Henry Ford’s son took over the family business he enquired into the firms cash reserves: it was around $700 million, all of it in the vault down in the basement. Henry didn’t like banks.

There are lots of places to park your money. Some of them are more certain than others. Right now you can currently park your money with the US treasury and they will promise to return it to you later, they will give you some interest – negative interest. I find that hard to think about. You are apparently better off storing your money in a vault in the basement.

That’s the TIPS curve, not the regular treasury curve. TIPS are inflation protected, which means they pay you the quoted rate PLUS the inflation rate.

Due to inflation, money you put under your mattress will lose value (in terms of purchasing power) over time. Although the short-term TIPS, having a negative real interest rate, will also lose value, they will lose less than the money under the mattress, because you will be compensated for inflations.

Joshua – Thanks. I’m an idiot.