“This Time is Different” is a fascinating book. It’s full of provocative confusing details. It does a wonderful job of helping to further the cause of making it clear economics has got a lot of work yet to do. There are lots of different large economic scale failure modes. Inflation, deflation, international debt default, intra-national debt default, etc. etc. I’m actually convinced they haven’t enumerated a very complete list; for example economic displacement isn’t on their list.

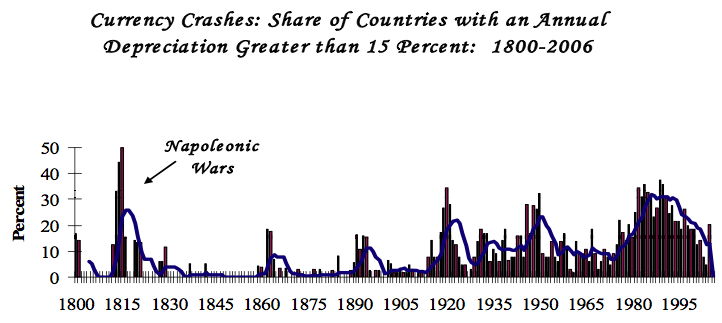

I am reminded of the observation in “Control of Nature” about LA canyon real estate. The catastrophic floods are rare compared to how often the property turns over so that residents tend to have no memory of what’s in store. People still remember the 70’s high inflation. But here’s a chart showing the incidence of deflation.

Here are three things, picked somewhat at random, from the book (so far) I found interesting.

When nations default on their international debt creditors have few effective responses. In passing them mention that American gun boat diplomacy visa vie South America arose out efforts to collect after Venezuela defaulted. That’s not really what I was taught in school about the Monroe Doctrine. There is an example of a nation losing it’s sovereignty upon defaulting on their international debt. I bet you didn’t know the Newfoundland was forced to merge with Canada by the Brits during the depression. But it’s so rare as to be the exception that proves the rule.

There is a nice turn of phrase “odious debt” used to loosely label debt that doesn’t deserve to be repaid. A simple example of odious debt would be that your country is taken over by a vile dictator who then engages in all kinds of vile behavior; meanwhile lenders in other countries continue loaning him lots of money; which he uses to further torture the population. Finally the citizens manage to eject him. That debt is odious and the new government decides to default on it. Of course there are other less colorful scenarios with less obvious outcomes familiar to anybody who’s observed bankers in the absence of consumer protections.

Finally they mention how in China and India the governments regulate things so that people have very limited choices when it comes to savings. They call this financial oppression; a turn of phrase I see has having great potential in our polarized political discourse. The governments also regulate what the banks can do with the deposits. People love to spin fanciful ideas about alternatives to the banking system, and I suspect you could find an interesting set of examples in such countries. For example they mention that savers turn to gold and jewelry as an alternative.

Peeve: http://en.wikipedia.org/wiki/Exception_that_proves_the_rule

Perhaps you’ve confused Nova Scotia with Newfoundland? Nova Scotia was one of the founding members of Confederation (1867).

Newfoundland lost its Dominion status in 1949 when England insisted Newfoundland become Canada’s 10th province.

And 1949 is some time after the Depression.

Luke – Right you are, sorry about that. I’ll fix it in a sec.

Doug – Peeve away! 🙂