A conversation with Brian reveals the interesting insight that many products emerge first as situated software; to use Clay’s delightful term.

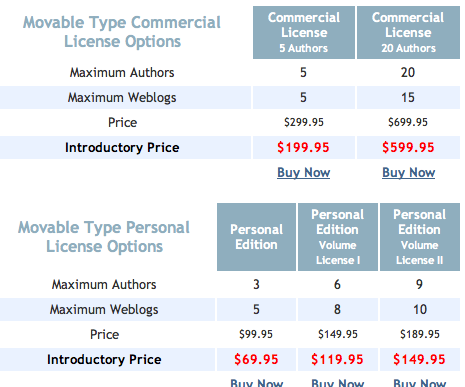

Consider for example MovableType. It emerged situated in the intersection of the set of people that could install Perl and the set of people who manifested a desire to rant (or reveal). For the longest time that community of people both limited it’s growth but at the same time forgave it any number of short comings. Finally the folks who wrote it budded off TypePad which eliminated a the Perl expertise portion from the embedded situation.

If you want to get dragged into conversation about membrane design again then you can turn up the knob and rant about how that’s another example of how public goods can be captured by private entities. But that’s somebody else’s rant.

All this is analogous to Clayton Christensen’s rants about how disruptive products seem to always emerge serving unserved customers. Such customers are both forgiving of the products short comings and they provide a strong demand signal that helps to shape the product that emerges. Both of these are necessary preconditions for creating something new.

Oh no, there are now two dudes named Clay in this posting; what’s up with that!

In any case.

Another point to make about situated software is this balance between a forgiving environment and a strong signal that helps the software to adapt.

“adapt” – I stole that from

Stefano.

The challenge in making a thing survive over time is getting it to adapt.

So among the benefits that a piece of situated software draws from it’s environment is this adaptive advantage. More forgiveness. Better feedback.

One reason that real world software is so much harder is that it’s unforgiving. One reason that Windows has thrived is that they have demanded a high level of forgiveness from their users. They get to do that because of the monopoly.

Economists should stop being so fixated on the pricing advantages a monopoly captures and turn their attention to the adaptive advantages. Oh wait, I’m getting dragged back into the membrane design discussion; I hate that discussion.