Some time back I mentioned a great essay on the huge difference in ethical norms between normal people and business people using the mortgage industry as an example. In effect home owners and thier friends see it as dishonorable to walk away from an underwater debt, while commercial actors see it as dishonorable not too. The commercial actor would probably call it incompetent or weakminded to keep paying an underwater debt you can walk away from. Last weekend Roger Lowenstein, in the NY Times magazine, had an article arguing that home owners should change their norms.

If your want to think about this question the first essay is much more interesting than the short article in the Times. But, Lowenstein did one thing that got me thinking. He enumerates a few examples of large banks walking away from large mortgages that they hold, mostly on commercial properties. For example a mortgage on five buildings in San Francisco. Which got me wondering about orders of magnitude.

It’s hard to be find good data but it looks like those mortgages were worth about 2 Billion dollars. Just cause it makes the arithmetic easy let’s assume that a house mortgage is typically two hundred thousand dollars. So that walk away is the equivalent of ten thousand home owners walking away from theirs.

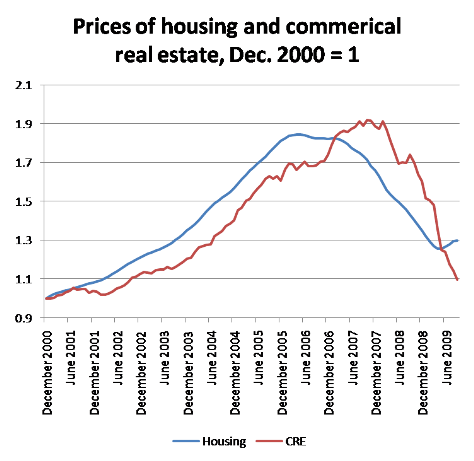

I don’t know what you can do with that number though. The commercial mortgage market’s troubles are lagging the homeowner market. There were about 2 Million foreclosures last year; and maybe 11 Million households that are underwater. But I haven’t seen numbers for how many commercial mortgages are underwater. Nor have I seen estimates for what the probabilities are that mortgage holders of various kinds will walk when they are underwater.

There is an argument that many household mortgage holders do not have the cash at hand to fund walking away. To walk they need to switch to renting, and that typically requires first and last months rent and possibly a security deposit. Walking away may save them a lot of money in a 2-3 year time frame, but they can’t pay the startup cost to stop the bleeding. Sounds like a opportunity for some clever banker, probably somebody in the check cashing biz.

via Krugman, got me thinking is that though the commercial real estate market peaked later their norms mean that they will walk away faster, while the housing markets norms mean the walk aways are going to play out much more slowly. Does that mean we will get a double whammy, both happening at the same time?

I’ve been thinking a lot about norms, because of this fascinating paper: Norm of Self-Interest (recommended many times by Andrew Gelman). It points out that once it becomes conventional wisdom that people act in a self interested manner people become increasingly likely to conform to that expectation. I’ve started noticing how often the when faced with a “why do you…?” attack people take shelter in the safe haven of a self-interest explanation. I too recommend it.

Walking away from a mortgage also means walking away from your neighbors; if you like your neighbors, that can be a real cost.

Ed – Oh, indeed. I read somewhere, if you move a hair salon even a block you lose a huge chunk of your ‘loyal’ customers. So I suspect even moving to a nearby rental has a tearing effect. That said if you bought near the peak of the bubble you may not have had much time to lay in roots.

That the social networks are hard place valuations on is just fascinating. For example it’s really painful for middle managers to execute layoffs forced on them by less connected senior managers.

But a hair salon or other commercial tenat generally doesn’t own/have the mortgage on their location – they rent from someone else who does. So foreclosure on commercial property is usually much less disruptive than private housing.

It would be interesting to have a more formal understanding of how the externalities of foreclosure/walk-aways differ between commercial and households. While the commercial foreclosures probably have fewer externalities on the tenants I’ve not doubt there are plenty.