To be clear I think we should treat petroleum consumption as a sin and tax it accordingly. Because it’s: a) murdering the planet, b) it’s a principle contributor to the war, c) it’s running out and we need to accelerate the switching to alternatives, and d) the cost comes out of producer pockets, and e) it’s funding people who in many cases are coming to despise us. I think lowering the tax is extremely bogus idea and a horrific diversion from other topics.

I gather that economists believe[1,2,3] that gas prices are largely unaffected by the gas tax. (That tax pays for highway maintainance, so it’s more like a user fee than a tax.) In fact I’ve heard it argued that if we raise the gasoline tax the effect will be to reduce the incomes of oil producers. I accept this logic, but I’ve had trouble seeing how to explain it in simple terms.

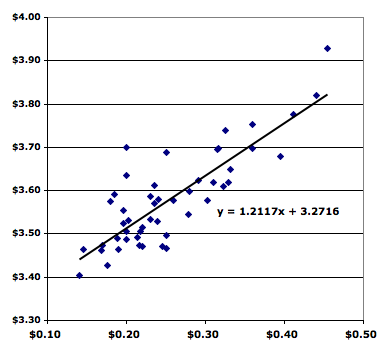

So rather than try to find a way to explain it i made this picture instead. This shows one dot for each state (except Hawaii and Alaska) plus the District of Columbia. The horizontal axis the the amount of gas tax [see] each state charges. The vertical axis is the price of gas in each state [see].

Oh dear. This doesn’t seem to be supporting the conventional wisdom. In fact it seems to say that a gas tax has a disproportionate effect on the retail price. Every 10 cent increase in the tax is corrolated with a 12 cent rise in the price the consumer pays. Huh?

My insta-theory for the amplified effect is that the tax rates are higher in states where the cost of doing business is generally higher. For example they have more services, health insurance, employee rights, education, regulation, etc. etc. As an aside I think it’s interesting that I view a high cost of doing business as a signal that a venue is highly attractive to business; while rhetorically it is often treated as a signal of a bad place to do business.

I must say that I don’t quite see how this chart supports the conventional opinion of the economists.

So, recalling that I think this that lowering the gas tax a very bad idea, my only reason for posting this is to dig into the evidence for the conventional wisdom. I love the idea that a high tax on petroleum products would largely come out of the producer’s pockets. If that’s true and you can convince a lot of people it should be a easy move toward a better outcome.