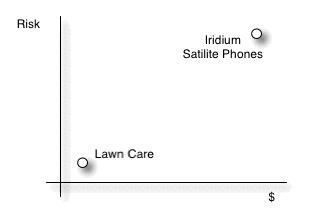

I’ve always liked this little B-School scatter plot. It compares different businesses showing how risky they are vs how much capital it takes bet on that venture.

In this example we have lawn care in the lower-right: low-risk, cheap-to-start-up. Generally low profits too. My canonical example for the upper-right is Motorola’s Iridium project; an adacious plan to transform the entire telephone industry by floating a huge mesh of satellites into low orbit.

This is a gambling game board. An economic entity (i.e. a person, a household, a small business, a rich man, a goverment, etc.) always decides how to spread it’s capital on the board. Even a poor man can usually buy a lottery ticket on the upper left. We are all allowed to take more risk than we can bear.

If you split your capital up you can diversify your risk somewhat. In exchange you get a more complex problem managing the risks. You can hire other people to do that for you, but that’s just a different kind of risk.

Motorola’s bet on Iridium hasn’t worked out and they have asked the court for permission to destroy the system. “Exit strategy.”

No man is an island so we all get to share in the jointly created gains and costs of this game. Iridium has certainly been very rough on Motorola and it percolates thru to the rest of the businesses under the Motorola umbrella.