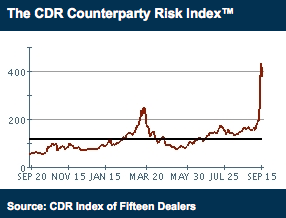

This graph shows the the Counterparty Risk Index, or CRI.

That 400 is basis points, or 4%.

“Upfront spreads on CDS of 16% mean that investors seeking protection on $100 million of debt would need to pay $16 million upfront and $5 million a year.” — from a longer article at Marketwatch

As the risk rises the chance of any given transaction taking place falls. I find it interesting to note that if you look after any venue where transactions are taking place you want this CRI to be low. It doesn’t matter where, playground, office, eBay, farmer’s market, does it? A trust thermometer.